Here is a great way to visualize the housing problems we are facing in 2022 from an article in Morning Brew

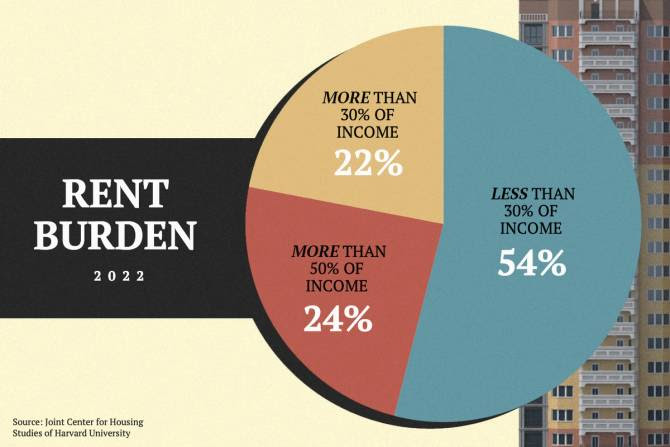

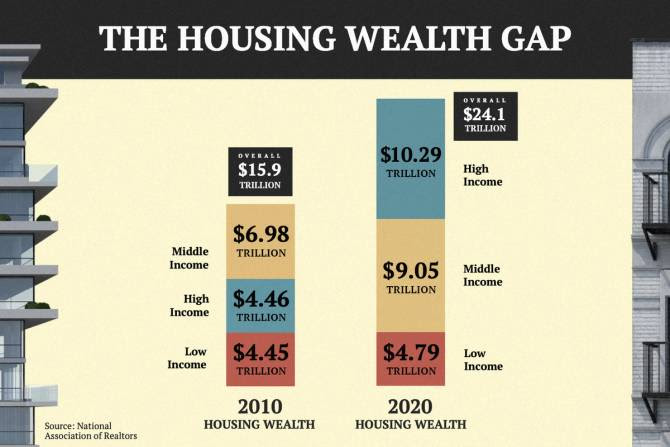

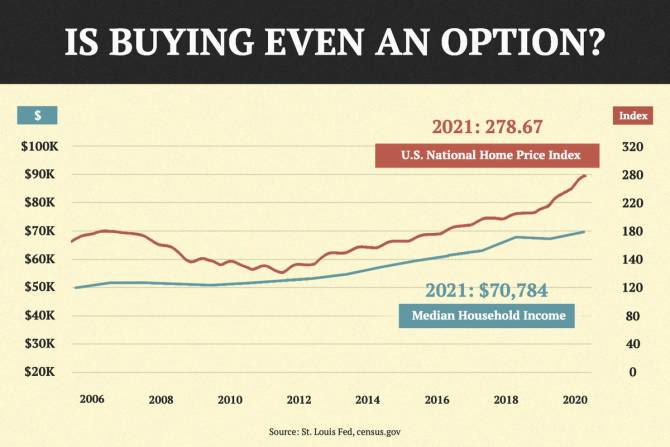

Here are some graphics to illustrate the current conditions of the real estate market for both prospective renters and homeowners. You’ll see why it’s so attractive to operate an Airbnb in New York, and how the housing wealth gap is widening the gap between those who have keys and those who do not.

Finding a place to live in 2022 hasn’t exactly been a breeze. Rents have skyrocketed, and mortgage rates have nearly doubled from their 2020 lows. As any Zillow lurker knows, prices are out of control for those bold enough to consider buying a house. The crisis is particularly hard on low-income renters who have seen an even greater share of their income go to housing and have fewer affordable options. It’s also been rough for first-time buyers, even as cities offer assistance programs and banks expand no-down payment mortgage programs.

It’s not just in big, notoriously expensive cities like New York and San Francisco. Costs are up across the country. After record-low mortgage rates gave more people the chance to buy and eviction moratoriums triggered by the Covid-19 crisis kept struggling households afloat, the tide is turning. Those too-good-to-be-true Covid rent deals are gone, as the average cost of a one-bedroom apartment is up 27% since last year. For buyers, the higher mortgage rates can mean paying an average $600 more a month than homebuyers who scooped up places in 2020 and 2021, when interest rates were hovering around 3%.

While low- and middle-income people struggle, the wealth gap is widening. Rent and mortgage payments are devouring the majority of income for many people. According to the Department of Housing and Urban Development, a household is “cost-burdened” if it spends more than 30% of income on housing. In 2020, 30% of households nationwide fit that description. And the rent-or-buy divide is furthering income inequality in America. As landlords rake in rent for overpriced one-bedrooms without dishwashers or views (forget in-unit laundry!), homeowners are still seeing their property values rise and their wealth grow, though that might be slowing down. Investors are finding the world’s largest asset class, residential real estate, extremely attractive as an opportunity for financial returns. That’s moving the needle further on who has property and who is left to wonder if they’ll ever get the chance to hold a deed.

The costs may be peaking. The average home price hit $413,800 in June and fell to $403,800 in July, according to the National Association of Realtors. But even as costs cool, they remain far above last year’s averages and still far out of reach of many people.

Corporations are becoming the most likely landlord.